News of Agribusiness Index

28.02.2017

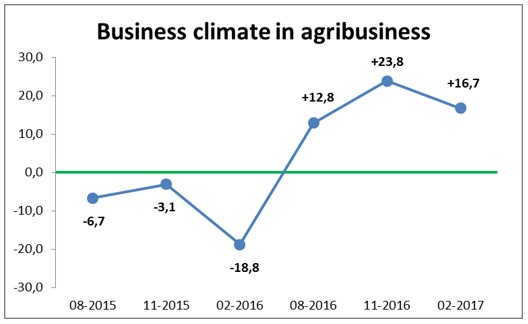

Agribusiness expectations show modest downslide

The sixth survey on “Agri business climate index” (ABI) was conducted in February 2017 by APD and UCAB. ABI includes two estimates: (i) an estimate of the current economic situation in the sector and expectations, called agri business climate, and (ii) an indicator of changes in the evaluation of the agri business climate (at the time surveyed) since the introduction of ABI in August 2015, named agri business index.

This time agri business climate was evaluated by the producers with +16.8 points, which is a modest downslide in comparison to November 2016. If compared to February 2016, when agribusiness climate was evaluated with -18.8 points, it shows considerable improvement. Despite fluctuations in agri business climate that may be caused due to seasonal impact, overall development trend of this estimate seems positive.

Nearly all factors surveyed downgraded agri business climate since November 2016 slightly, whereas producers still evaluate their general economic situation as quite good (+30.7 points). Main factors with positive impact are: (i) productivity level (+34.7 points), (ii) access to qualified staff, machinery and equipment (+25.6 points) and (iii) access to qualified employees respectively professional knowledge (+25.6 points). Factors with negative effects are: (i) lack of public support

(-41.2 points), (ii) impact by general economic situation (-40.2 points), (iii) access to external capital and resources (-18.3 points). Since the beginning of the survey there seems a pattern, referring to confidence in management capabilities of producers on the one side and lack of trust in the policy framework on the other side. - Although state support and general economic situation are considered by the respondents as factors with negative impact on business climate, their agri business indices are the highest among all of the factors analysed. In particular, business index of public subsidies was estimated at the level of 127.2, and of macroeconomic impact at the level of 126.3, indicating to improvements in evaluation of these factors in comparison to the base period. The lowest value of agribusiness index was estimated for the factor “access to qualified staff”, 99.3.

This time agri business climate equals +13.0 points in the Center, +17.0 points on the South, +15.0 points on the North-East and +27.6 points in the Western region of Ukraine. - The highest value of agri business index is estimated for producers in the Western region at a level of 123.6, followed by those in the Central region with 119.8. Only producers in the Western region have improved their evaluation of business situation since November 2016. Business indices in the North-East and South regions are estimated at a level of 111.1 and 109.7, respectively.

For the third successive time all producers, regardless of the size of their land bank, evaluated business climate positively, whereas evaluation of agri business climate by one of the major producer groups, namely producers with less than 5000 ha agriculture land, is marginal at a level of +0.2 points. There seems to be a clear pattern, that larger producers, such as agricultural holdings and farms with a land bank above 5000 ha evaluate business climate more positively than the rest. This is likely to be related to the access to foreign markets and effects of scale economies. – As regards to business index households are improving their evaluation significantly, reaching 139.6 during the current survey, whereas all other producers range their evaluations of the index around 100.

With regard to the evaluation of business climate by producers, grouped according to their specialization, estimate of business climate by animal producers is barely positive,+1.1 points, whereas crop producers have indicated to +12.1 points and producers of mixed output, represented mostly by households, to +24.6 points. Most significant change in evaluation of business climate since November 2016 was observed for crop producers+27.4 points at that time. This is likely to be related to seasonal impacts on plant production. Also short term business opportunities might play their role here. - The highest value of business index is estimated for producers with mixed output (139.6). These producers are mainly represented by households. Business indices for animal and crop producers are considerably lower at 99.8 and 100.7, respectively.

Note: “Agri business climate index” (ABI) of Ukrainian agri industry was developed and introduced with common efforts of German-Ukrainian Agricultural Policy Dialogue (APD) and association “Ukrainian Agribusiness Club” (UCAB) on the base of German general business index. The analysis is conducted quarterly via a survey of 400 agriculture producers and consists of two estimates: “Business climate” determines subjective estimation of both current business situation and one year business expectations. Business climate may change from -100 (very poor) over 0 (indifferent) to +100 (very good) points. “Business index” represents the change in the evaluation of the business climate (at the time surveyed), normalized to the values of the first ABI survey, conducted in August 2015 (values over 100 indicate improvement, and below 100 suggest degradation of business climate).

ABI methodology is available under: /ua/ukab_proponue/abi/